What Types of Residential Properties Can Foreigners Buy in Singapore?

This article discusses what types of properties foreigners can buy in Singapore, exclusive properties in Sentosa Cove, cost and process of buying a property in Singapore

Singapore has become a hot spot for foreign investors due to its political stability, steady governance, efficiency, transparency, and positive business climate. One of the main concerns of foreign investors is whether they’re allowed to buy any house in Singapore.

The answer is yes, but the questions still remain, “Who does the government regard as a foreigner? And which types of properties are they allowed to buy?”

Table of Contents

Who is Legally Considered a Foreigner in Singapore?

Properties that Foreigners Can Buy & Properties with Restrictions

Properties with No Restrictions for Foreigners

Landed Property in Sentosa Cove

How You Can Apply for Permanent Residency

Cost of Buying Property for Foreigners

Property Buying Process in Singapore

Who is Legally Considered a Foreigner in Singapore?

Under Singapore’s Residential Property Act, foreigners are people who do NOT fall under any of the following categories:

- Singapore citizens;

- Singapore businesses or companies;

- Singapore limited liability partnerships;

- Singapore associations.

Therefore, all Singapore Permanent Residents (SPRs), expats with student passes, work passes, and long-term visit passes are regarded under the law as foreigners.

Properties that Foreigners Can Buy & Properties with Restrictions

If you are a foreigner living in Singapore, you need to understand which residential properties you are allowed to buy, and which types come with restrictions for foreigners. The government runs on a mindset of a scarcity of land policy in which every square foot of land matters in terms of its plans for urbanisation.

As Singapore moves towards more growth and prosperity due to its open economy, there will be greater demand for housing from people arriving from all over the world, adding to the housing demands of local residents.

These factors mean that the government must carefully regulate the housing market by constantly adjusting the economic policies related to housing. This is to avoid housing shortages sooner than anticipated, even during times of strong demand and the risk of citizens being forced to live in houses the size of bird cages.

Properties with No Restrictions for Foreigners

The following are the types of properties that foreigners are allowed to buy:

- Shophouses and HDB flats if they meet eligibility requirements

- Private condominium units

- Strata landed houses in an approved condominium development

- A leasehold estate located in a landed residential development. Term must not exceed seven years to include any term extension that may be granted due to a renewal option

- Shophouses located in land plots designated for commercial development

- Executive Condominiums (ECs), which were privatised 10 years after the date the Temporary Occupation Permit (TOP) was obtained

- Landed property at Sentosa Cove

Among those regarded as foreigners, there are distinctions between what Singapore Permanent Residents (SPRs) are allowed to buy as opposed to non-Singapore Permanent Residents (non-SPRs). These are spelled out in the table below:

|

Types of Property |

SPRs |

Non-SPRs |

|

HDB Built-to-Order (BTO) Flats |

Yes, if married to a Singapore Citizen |

No |

|

HDB Resale Flats |

Yes, if married to a Singapore Citizen or to another Singapore PR. For PR couple, both must have had PR status for 3 or more years |

Yes, if married to a Singapore Citizen |

|

Executive Condominiums (ECs) |

Yes |

Only privatised ECs after having TOP for 10 years or longer |

|

Private Apartments / Condominiums |

Yes |

Yes |

|

Strata landed homes / Townhouses in an approved condominium development |

Yes |

Yes |

|

Landed Property at Sentosa Cove |

Yes |

Yes, only for owner-occupation purposes |

This makes clear that there are specific eligibility requirements that must be adhered to when buying an HDB resale flat. Therefore, you may want to think about buying an upgraded property like a condo. Condominiums in Singapore are located in gated neighbourhoods with shared facilities for residents only. These include swimming pools, fitness centres and barbecue pits. These developments are commonly called private housing projects.

Restricted Properties

Due to the scarcity of land, there are restrictions in place for foreigners wanting to purchase a landed property on Singapore’s main island.

Therefore, you must write to the Singapore Land Authority’s (SLA) Land Dealings Approval Unit (LDAU) if you are considering buying any of the following:

- Vacant residential property

- Terrace house

- Semi-detached house

- Detached house / bungalow

- Strata landed house not located in an approved condominium project under the Planning Act (e.g., cluster house or townhouse)

- Shophouse (for non-commercial purposes)

- Association premises

- Places of worship

- Workers’ dormitory / boarding houses / serviced apartments

Assessment Criteria

|

The assessment criteria are as follows: |

|

|

Landed on Singapore’s main island |

Landed property at Sentosa Cove |

|

Approval is based on individual merits. However, the main requirements are: 1) Must have minimum SPR status 2) Must make a sufficient economic contribution to Singapore in terms of the following: • Professional, academic and/or tech qualifications • Expertise and/or professional experience needed in Singapore • Investments made in the types of industry and/or service sector needed in Singapore

|

1) SPRs are eligible. Foreigners must get Singapore Land Authority (SLA) LDAU’s approval. 2) Only for owner-occupied 3) All other rules are much like those of other landed properties located on the mainland

|

Foreigners must meet the conditions spelled out in the Residential Property Act:

- Once the application to purchase a restricted property is approved, he/she can only own one restricted property and they must occupy the residence themselves. This cannot be purchased as an investment property, so the owner is not allowed to rent it out.

- The Minimum Occupation Period (MOP) is five years. This means the owner cannot sell it before then, except for a property in Sentosa Cove. Singapore’s Controller of Residential Property oversees restricted properties and has the power to lodge a caveat on them to keep them from being sold during MOPs.

- Land size must not be more than 15,000 sq. ft. or 18,000 sq. ft. in Sentosa Cove. This applies to both leasehold and freehold properties.

- Owners who relinquish their citizenship or PR status must sell the restricted properties they own within two years.

- Foreigners who inherit a restricted property without approval from LDAU must sell it within five years of the date they inherited it. This means they have five years to gain approval.

- If a foreigner purchases vacant land to build their own home, they must finish building it within 36 months. Their five-year MOP starts when they receive the Temporary Occupation Permit (TOP) or Certificate of Statutory Completion (CSC), whichever comes first.

- If a foreigner is moving from one restricted property to another, he/she must sell the first restricted property within three months of the date he/she takes possession of the second property.

- Singapore citizens cannot hold restricted properties on trust for a foreigner. Such a trust would be null and void.

Foreigners Must Meet Certain Requirements to be Approved

For a foreigner who is neither a Singapore citizen nor a Singapore Permanent Resident, you would need to show authorities the following before you could be considered for approval to buy a restricted property:

- Educational background

- Professional and/or technical qualifications

- Career history and scope

Application Process

Foreigners will be charged a $1,220 non-refundable application fee each time they apply. Approval is granted case-by-case. Applicants improve their odds of being approved if they can prove that they’ve made substantial economic contributions to Singapore, according to SLA.

To apply, either go online to SLA’s website or contact them at 6478-3444. Otherwise, you can go to their office at: Singapore Land Authority – Land Dealings Approval Unit, 55 Newton Road, #12-01 Revenue House, Singapore 307987.

Landed Property in Sentosa Cove

You have likely heard of Sentosa Cove, the very desirable Balinese-like island located on the eastern side of Sentosa. This development is known for being “made for the rich” and is near a resort with a lot of tourist attractions, like Universal Studios and other landmarks. As named in the list above of restricted properties, landed homes can only be sold by expats when they’ve received LDAU approval.

However, when it comes to Sentosa Cove, foreigners (SPRs and non-residents) can buy a landed house in this incredibly exclusive island location as long as they are able to afford it. But it doesn’t hurt to put in a request anyway and this is what we would recommend. We have heard that approval can come within 48 hours.

Sentosa Cove is the only enclave in Singapore primarily meant for expatriates, even so there are still some “crazy rich” Singaporeans who own units there. This means that you can definitely expect some market freedom in Sentosa Cove.

You might also like to know that Sentosa Cove is located on a man-made island and all the houses there are on leasehold property with a 99-year tenure. These homes are for owner-occupier purposes only and not for an investment. So, it’s against the law for you to rent your house out in Sentosa Cove.

Also, for landed properties on the mainland that are usually only sold to Singapore citizens or SPRs, there is a MOP of five years. However, this rule does not apply for homes in Sentosa Cove. But you are only allowed to buy one property and it must be on no more than 1,800 sq. metres of land.

Investments in Singapore

Applicants with large investment portfolios get the most consideration with housing investments making an especially good impression!

To gain approval you must be considered the “cream of the crop” with something substantial to add to Singapore’s economy. You must show that you are willing and able to help the economy reach greater heights. This makes perfect sense, right?

For example, the CEO of Hai Di Lao, Zhang Yong, and his son Zhang Hanzhi each purchased a Good Class Bungalow (GCB) at different times, Yong in 2016 and his son in 2021. The decision was made as both properties are located in the same cul de sac, giving the billionaire family much-needed privacy. Because of Yong’s huge contribution to the Hai Di Lao restaurant chain in Singapore, he was allowed to become a naturalized Singapore citizen in 2018.

How the Rich & Famous Gain SPR Status

Singapore is known for its highly rigorous screening process for foreigners to gain Permanent Residency status. But what it really comes down to is how much they can contribute to the country. Therefore, it’s not surprising that famous people like Jackie Chan and Jet Li have been able to secure this very enviable status.

Another well-known person who made headlines in Singapore with a giant business decision is Sir James Dyson. Soon after becoming an SPR, he bought a Good Class Bungalow (GCB) at Cluny Hill costing $50 million. This is an extremely desirable landed estate with properties selling for huge amounts of money. He has since moved back to the UK, but his SPR status remains confidential. The public has no idea if he has relinquished it or not.

What did Sir James Dyson offer Singapore’s economy? He decided to move Dyson Headquarters to Singapore, locating it at Telok Blangah’s historic Saint James’s Power Station. This move created substantial job opportunities for Singaporeans, which is why he was given permanent residency status.

How You Can Apply for Permanent Residency

By now, you’re probably wondering how you can apply for SPR status, which would open the door to many more housing options for you.

For expats to be considered for PR status, you would need to meet some specific requirements set by the Economic Development Board (EDB) and detailed below:

The EDB administers the Global Investor Programme (GIP), which allows foreigners to be considered for PR status as long as they invest a minimum amount of money in business start-ups and/or invest in other ventures that contribute to the country’s economic development. These could be in the form of trusts or foundations, venture capital funds, or the like.

An investment in private residential properties will also be considered for a foreigner applying for PR status. If he/she invests a minimum of S$2 million in business start-ups and/or other investments like trusts or foundations, venture capital funds, and/or private residential properties, his/her application will be considered.

As much as 50% of said investment can be for private residential properties, as long as it complies with the Residential Property Act (RPA) in terms of foreign ownership restrictions. The idea is to attract foreign talent to Singapore and keep them here.

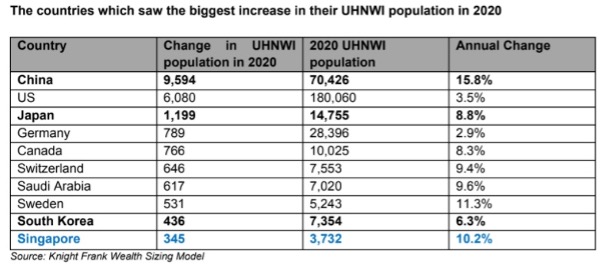

With an influx of ultra-high net worth individuals (UHNWI) coming to Singapore and starting business in our homeland, we should soon see an uptick in the number of expats following suit. Given the attractive business climate and available business opportunities in Singapore, we expect to see many more settling down here.

The table below shows the growth in UHNWI country-by-country in 2020.

Courtesy of Business Times

Cost of Buying Property for Foreigners

1. Buyer’s Stamp Duty (BSD)

Everyone, including expats are required to pay Buyer’s Stamp Duty (BSD), which is a tax owed when buyers sign transaction documents related to the purchase of property.

|

Purchase Price or market value of property |

BSD Rates for residential properties |

BSD Rates for non-residential properties |

|

Initial $180,000 |

1% |

1% |

|

Following $180,000 |

2% |

2% |

|

Following $180,000 |

3% |

3% |

|

Remaining Amount |

4% |

3% |

2. Additional Buyer’s Stamp Duty (ABSD)

In addition, buyers must also pay an Additional Buyer’s Stamp Duty (ABSD) if this is their second or subsequent property they’re purchasing.

|

Status of Buyer |

ABSD Rates |

|

Singapore Permanent Resident (SPR) buying their first residential property |

5% |

|

SPR buying second residential property |

25% |

|

SPR buying third or subsequent residential property |

30% |

|

Foreigner (FR) buying residential property |

30% |

The ABSD rules allow for certain nationalities to be excluded because they fall under the alliances formed in Free Trade Agreements (FTAs). Foreigners from countries with FTA ties to Singapore may be Eligible for ABSD Remission.

Under their respective Free Trade Agreements, Nationals and Permanent Residents of the countries listed below will pay the same Stamp Duty as Singapore Citizens:

- Nationals and Permanent Residents of Switzerland, Norway, Liechtenstein, and Iceland

- United States Nationals

3. Conveyancing Attorney’s Fee

A conveyancing attorney will be needed for property transactions in order to ensure that title to the property is transferred to buyers without any encumbrances. The conveyancing fee is a one-time charge that can range anywhere from $1,600 to $3,000. This will depend on the amount being transacted, and whether any mortgage financing is involved to purchase the property, which would require more work in coordinating with the relevant authorities and banks.

4. Mortgage Duty

If you are taking out a mortgage loan, there would be a mortgage duty owed on your mortgage document in which there is an interest or shares in immovable property being transferred from you as the borrower to your lender to secure the loan. The mortgage duty will be 0.2% to 0.4% of the amount of the loan, up to a maximum of S$500.

5. Real Estate Agent’s Commission

Experienced real estate agents are worth every dollar of the commission they’re paid. They can offer invaluable market advice and find houses that not only meet your requirements but are also within your price range. You can count on your agent to handle difficult negotiations on your behalf and refer you to qualified conveyancing attorneys, mortgage bankers, and renovation contractors.

If you are looking at HDB resale flats, you can expect to pay a 1% commission to your agent. On the other hand, if you are looking for a private condo, it is unlikely that you will be required to pay a commission. In most cases the buyer’s agent is paid by the seller’s agent due to a commission-sharing arrangement between the agents.

Property Buying Process in Singapore

1. Use Pinnacle’s Affordability Calculator

Once you’ve determined which neighbourhood you want to live in, you can use the Pinnacle Affordability Calculator to find out whether you can afford property there. Calculations are based on government regulations currently in place as well as any cooling measures affecting real estate. This should only take you five minutes.

2. Go Online and Look Through Property Listings

Browse property listings on real estate portals like PropertyGuru.com.sg and 99.co. These are the top two real estate portals in Singapore, providing visitors with information on a comprehensive list that includes private condos, ECs, resale HDB flats and recent private property launches. You can search based on your preferred location and price range.

You may also want to consider how close you would be to the types of amenities you want access to. These may include parks, recreation, shopping, and entertainment facilities, as well as MRT stations. Other factors to consider might be proximity to work and economic drivers.

For more information and insights check Districts In Singapore and HDB Estates.

3. Engage an Experienced Real Estate Agent

An experienced real estate agent can offer invaluable market advice, find houses that meet your requirements and are within your price range. Your agent will also handle the negotiations on your behalf. You can also ask your agent to recommend reputable conveyancing attorneys, bankers, and renovation contractors.

When browsing through the listings online, make note of the ones you like and send them to your agent, so he/she can get more information on the property. Your agent will also arrange in-person visits for the properties you like.

4. Apply for Financing

Foreigners can apply for a mortgage loan to buy property in Singapore. If you qualify, you can borrow up to 75% of the property’s purchase price if this is your first property purchase and borrow up to 55% on a second Singapore property.

For more information, read Step-by-Step Guide to Obtaining a Mortgage to Purchase a Property in Singapore.

5. Make an Offer & Close the Deal

Once you find the home you want, whether it’s an HDB flat or private property, it’s time to make an offer and close the deal.

For purchase of a HDB resale flat, you will make an offer with an option fee of usually $1,000 in exchange for an HDB prescribed Option to Purchase (OTP) which is valid for exactly 21 days. Within these 21 days, buyers will apply for valuation of the flat rhough HDB Resale Portal, and settle for mortgage if taking loan from a bank. Upon agreeing to proceed with the purchase, buyers will pay the balance $4,000, and sign on the OTP. Buyers and sellers will then submit HDB resale application via the HDB Resale Portal. Read more on Complete Guide to Buying HDB Resale Flat.

If you’ve chosen a private residential property such as condominium, you must first pay an option fee, which is 1% of the purchase price. Then, get your financing approved and within two weeks pay the balance of the option fee, which is 4%. For the remaining balance of 95%, up to 75% can be financed by a bank SPRs can have the option to finance the remaining 20% (or more if the loan from the bank is less than 75%) using funds in their CPF Ordinary Account whereas foreigners have to pay in cash. For more details, read How & What to Pay when Buying a Property in Singapore?

Disclaimer: The information provided in this article does not constitute legal advice. We recommend that you get the specific legal advice you need from an experienced attorney prior to taking any legal action. While we try our best to make sure that the information provided on our website is accurate, you take a risk by relying on it.

At Pinnacle Estate Agency, we strongly believe in sharing our real estate knowledge to the public. For more content like this article, check out our Singapore Property Guides.