HDB Minimum Occupation Period (MOP): Everything Flat Owners Need to Know

This article discusses the overview of MOP, what flat owners can't do with their flat within MOP, the importance of MOP, and many more

You may have all kinds of reasons for deciding to put your HDB flat on the market. It may be that you’ve found another flat that you like better that’s closer to family. Or maybe it’s a matter of needing cash in a hurry, and the only asset you have to sell is your home. Before listing your flat with a property agent or placing ads, you need to make sure that HDB Minimum Occupancy Period (MOP) won’t prevent you from selling.

Table of Contents

If my HDB MOP still isn’t over, can I sell my flat?

How can I find out when my HDB MOP is up?

What is HDB’s MOP?

Whether you bought your HDB flat directly from HDB, from an individual owner on the resale market, or directly from HDB, you are required to comply with HDB’s MOP.

The MOP is the amount of time that HDB requires flat owners to physically reside in the flat prior to either renting it out or selling it. The MOP also applies when buying another private residential property such as apartments or condos.

It’s important that you know when this time period begins, which is on the date that you picked up your keys. Also, if there is a period of time when you’re not living in your flat, that time doesn’t count. For example, if you had been living there for four years, but spent the fifth year staying with a relative overseas. Upon your return, you are required to make up that fifth year before you would be allowed to sell your flat, rent it out, or even purchase another private property.

The HDB MOP policy is there to keep people from buying a flat just to immediately put it on the market, so they can make a quick profit by flipping it.

How long the MOP is for your flat depends on how you bought it, the type of flat, and the date on which you applied to buy your flat.

|

Type of Flat |

MOP |

|

Flats purchased directly from HDB (e.g. Build-to-Order (BTO) flats, executive condominiums (ECs)) |

5 years |

|

Design, Build and Sell Scheme (DBSS) flat |

5 years |

|

Resale HDB 1-room flat (purchased with or without CPF Housing Grants) |

No MOP |

|

Resale HDB 2-room flat or larger (purchased with or without CPF Housing Grants) |

5 years |

|

5 years from the date possession of the replacement flat takes effect, or 7 years from the date the replacement flat is selected whichever is earlier |

|

|

Flats purchased under the Fresh Start Housing Scheme |

20 years |

What MOP Does Not Allow?

As discussed above, you cannot list your flat for sale within the MOP period. This is not the only thing you’re not allowed to do during your HDB MOP. You also cannot rent your entire flat out or buy any type of private property.

As long as you’re living there, even if you’re only occupying one bedroom, you are allowed to have tenants rent your extra rooms. This applies as long as each tenant is renting for at least six months. If not, you are at risk of having HDB take back your unit. You are only allowed to have a total of six people living in your HDB flat at any one time, including you (the owner) and your family. If your flat is 3 rooms or larger, you are allowed to rent the bedrooms out.

If you decide to have tenants rent some of your rooms, you need to abide by HDB rental rules and regulations. Also, you are not allowed to lock the door on one bedroom pretending it’s yours when you’ve really moved and rented the entire flat to others. You would be breaking the law and any income you’d make would not be worth the penalty.

The Importance of HDB’s MOP

The main purpose of owning an HDB flat in Singapore is to have a place to live, not to make money on an investment. Having an MOP keeps people from buying a flat just to immediately put it on the market, so they can make money by flipping it. This policy prevents investors from artificially inflating the prices of public housing.

There is just one exception to the MOP policy, which is for 1-room resale flats that are being purchased without any grants. This means that someone can buy and resell a 1-room flat without having to worry about how long they’ve lived there.

If my HDB MOP still isn’t over, can I sell my flat?

You may be able to get HDB to buy your flat back before your MOP has run if you meet one or more conditions. However, whether this succeeds or not depends on your situation.

These conditions would be the following:

- Bankruptcy: If you are facing bankruptcy but could avoid it by selling your flat and moving into a less expensive one, HDB may allow it.

- Divorce: This is why most people need to sell their flat prematurely before they’ve met their MOP. In this case, the couple would be allowed to sell their home, dividing up the proceeds.

- Cannot pay the home loan: Should the family’s sole breadwinner become disabled or even die, leaving the family with no way to pay the loan on their home, HDB may be open to allowing the family to prematurely sell their flat.

- Terminally ill: Each of these cases are assessed individually based on their merits.

- Renouncement or loss of citizenship: If you’re going to permanently move overseas, HDB may allow you to sell your house before meeting your MOP. If so, you will get your CPF funds returned to you.

Note: If you are facing bankruptcy and/or a divorce, there are several more requirements that you would need to meet before you can prematurely sell your HDB flat.

Bankruptcy

If the HDB flat is completely owned by non-citizens, they would need to obtain permission from the Official Assignee prior to being able to sell their flat. However, if at least one of the flat owners is a Singapore citizen, this would not be required.

Divorce

If your divorce occurred after you met the MOP, you must provide the following documents:

- Writ for Judicial Separation; or

- Interim Judgment and Certificate of Making Interim Judgment Final; or

- Divorce Certificate (for Muslims); and

- Order of Court (if any)

You may be interested in How is HDB Flat Divided in a Divorce?

How can I find out when my HDB MOP is up?

Are you unsure how long it will be before you will be allowed to sell your flat or purchase another private property? Use your SingPass to login to your MyHDB page and under My Flat go to Purchased Flat > Flat Details > Minimum Occupation Period (MOP).

My MOP has been met, and now I want to move, either by selling my flat or renting it out. What else do I need to comply with?

Selling

Now that you’ve met your MOP and you’re ready to sell your flat. Register Intent to Sell with HDB. This is previously known as Resale Checklist.

Once your registration is complete, the portal will display information on the following:

- Singapore’s Ethnic Integration Policy/ Permanent Resident Quota in effect for your block: This will tell you whether there are any restrictions in place for selling your flat to particular races or to Singapore Permanent Residents at the moment. This information is updated on the 1st of each month, which means it’s only valid for the duration of that month. You will need to check back when the status changes at 12:00 a.m. on the 1st of the following month and subsequent months after that.

- Status and billing of costs related to upgrading: Home Improvement Program (HIP), Lift Upgrading Program (LUP), or Main Upgrading Program (MUP).

- Prices of the most recent HDB resale transactions in your vicinity and more precisely, in your block. Our article on How to Price Your Property Right may be helpful.

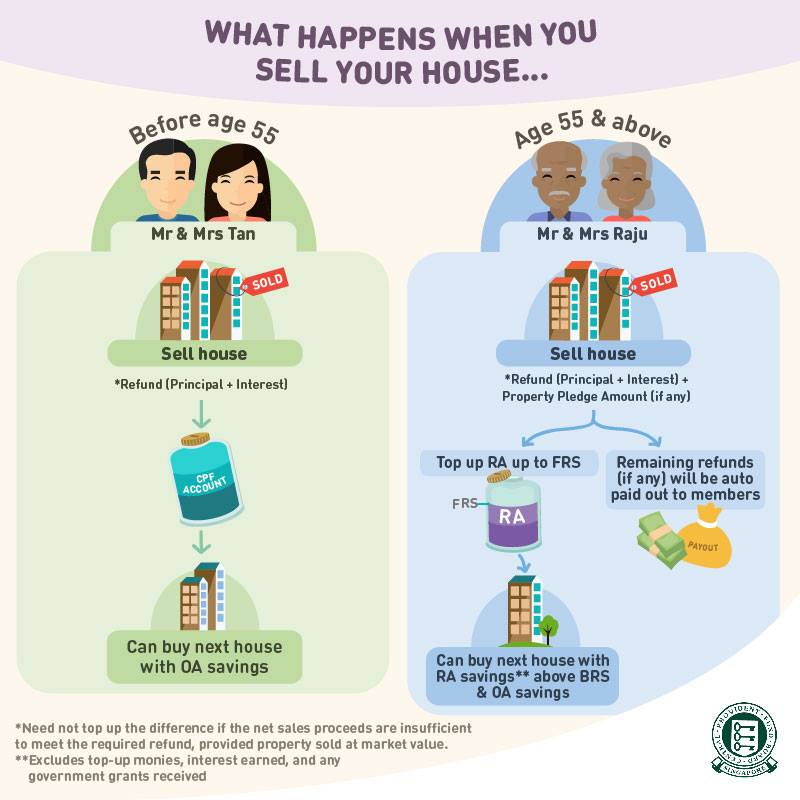

Next, it’s time to start crunching numbers. Fortunately, the HDB Resale Portal is equipped with a calculator to help you determine how much money you’ll likely pocket from the sale using your proposed selling price.

It’s important that you calculate this correctly, so that you will know how much cash you will have on hand to finance the purchase of your next home.

For further information on selling HDB flats, read How to Sell Your HDB Flat On Your Own?

Renting

Before an owner is eligible to rent their HDB flat out, they must meet the following three requirements:

Singapore Citizens

To be allowed to rent out the entire flat to tenants, at least one owner must be a Singapore Citizen (SC). Owners with Singapore Permanent Residency (SPR) status can only rent the bedrooms out, not the whole flat.

Non-Citizen (NC) Rent Out Quota

If you intend to rent your flat to one or more tenants who are non-citizens of Singapore and/or non-Malaysian, you are required to comply with the NC Rent Out Quota. This quota is 8% for neighbourhoods and 11% for blocks. This applies to Singapore Permanent Residents (SPRs) as well as foreigners unless they are Malaysian nationals. But if you are only going to rent out your bedrooms, the quota won’t apply.

In a neighbourhood and/or block where the NC Rent Out Quota is full, owners are only allowed to rent their flat to Singapore Citizens and/or Malaysians. This quota is adjusted on a monthly basis and determined by tenant movement in other flats located in the same neighbourhood or block during the previous month. The quota is updated at midnight the 1st of every month. To find out whether the NC Quota of the block your flat is located on, you can refer to the HDB Map Services or HDB InfoWEB.

To show your prospective tenant that you are eligible to rent out your flat, just print out your eligibility to rent confirmation from the HDB. You can get this from My HDBPage by logging in with SingPass and then going to My Flat > Purchased Flat - Renting Out > Renting Out of Flat.

For further information on renting HDB flats out, read Ultimate Guide to Renting Out Your HDB Flat Without Engaging an Agent.

Disclaimer: The information provided in this article does not constitute legal advice. We recommend that you get the specific legal advice you need from an experienced attorney prior to taking any legal action. While we try our best to make sure that the information provided on our website is accurate, you take a risk by relying on it.

At Pinnacle Estate Agency, we strongly believe in sharing our real estate knowledge to the public. For more content like this article, check out our Singapore Property Guides.