How Will Home Borrowers be Impacted When Banks Switch from SIBOR/SOR to SORA?

This article explains the differences between SIBOR, SOR, and SORA, and how homeowners will benefit from transitioning and eventually switching their floating loan packages from SIBOR/SOR to SORA

Between now and 2024, thousands of floating-rate home loans will need to be replaced with new loan packages. In Singapore, these billions of dollars in loans are currently based on two interest rate benchmarks, the Singapore Interbank Offered Rate (SIBOR) and the Singapore Dollar Swap Offer Rate (SOR), both of which are now being phased out.

If you already own a home in Singapore, or are in the market for one, you’ve likely heard about the Singapore Overnight Rate Average (SORA). This new type of home loan package is replacing current property loan packages based on SIBOR/SOR.

The process of switching all existing property loans based on SOR has already begun with banks in Singapore. The process is set to be complete by 31 October 2022, so that SOR can be phased out by 30 June 2023, which is the deadline.

Borrowers with loans based on SIBOR will also need to switch their property loans over to SOR. This must be done by 31 December 2024, when SIBOR reference rates are due to be discontinued.

You can be confident that the new SORA benchmark rate is intended to improve financial matters for consumers, not just make things more complicated.

This article will discuss the transition over to SORA and the benefits it offers homeowners.

SOR | SIBOR | SORA

| SOR | SIBOR | SORA | |

| What it stands for | Singapore Dollar Swap Offer Rate | Singapore Interbank | Singapore Overnight Rate Average |

| What it is | The synthetic rate of borrowing SGD by borrowing USD of the same maturity and converting them to SGD | The trimmed arithmetic mean of panel banks' submissions on the expected rate at which they can borrow funds in the interbank market | The volume-weighted average rate of borrowing transactions in the unsecured overnight interbank SGD cash market in Singapore |

| Who administers it | The Association of Banks in Singapore Benchmarks Administration Co. (ABS Co.) | The Association of Banks in Singapore Benchmarks Administration Co. (ABS Co.) | The Monetary Authority of Singapore (MAS) |

The Singapore Overnight Rate Average (SORA) is a benchmark interest rate that is set to replace the following ones that banks are currently using to determine interest rates when they offer property owners floating-rate loans:

- Swap Offer Rate (SOR)

- Singapore Interbank Offered Rate (SIBOR)

Keeping it simple, SOR, which is primarily used for commercial loans, is based on how much it costs to borrow US dollars (USD) and convert them to Singapore dollars (SGD). On the other hand, SIBOR is based on how much interest banks expect to pay to borrow from each other. Both SOR and SIBOR have been the primary benchmarks that banks in Singapore have used for determining floating-rate loans over the past two to three decades. The Association of Banks in Singapore Benchmarks Administration Co. (ABS Co.) has been the administrator of both rates.

SOR and SIBOR in certain aspects are both associated with the London Interbank Offered Rate (LIBOR), an international benchmark. This too is being discontinued, with the process having already started. LIBOR has in fact been proven to be susceptible to manipulation, which occurred in 2012 when a number of international banks conspired to do this. As a consequence, those banks suffered very heavy enforcement action.

Due to these events, international authorities have been collaborating with banks to discontinue the use of benchmarks like SOR, SIBOR and LIBOR when determining floating rates.

SOR uses LIBOR in its calculations, so in Singapore SOR will no longer be used after 30 June 2023 when USD LIBOR is set to be discontinued. The Association of Banks in Singapore (ABS) has chosen to phase out SIBOR as well, which will be done over the next two or three years.

The 6-month SIBOR is on schedule to be fully phased out by 31 March 2022, with the 1-month and 3-month SIBOR no longer being used after 31 December 2024. In preparation for SIBOR’s discontinuation, all financial institutions are no longer using SIBOR when issuing new loans.

As banks start using SORA for their home loan packages, homeowners in Singapore will benefit in two ways:

1. SORA is Transparent & Reliable

The overnight borrowing transactions of banks in Singapore form the basis of SORA, which the Monetary Authority of Singapore (MAS) continually administers.

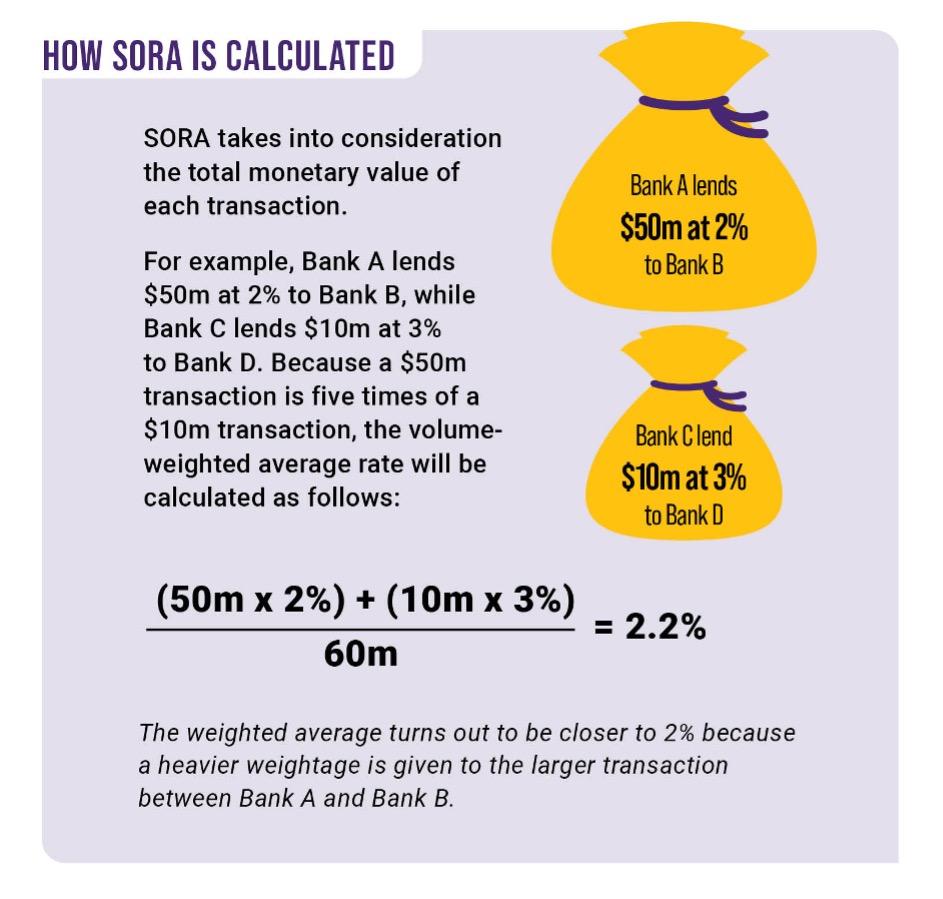

To calculate SORA, MAS requires a number of banks in Singapore to disclose the daily data on all applicable financial transactions. At the end of each day, MAS verifies the validity of the banks’ reports and determines the average rate (based on volume) of all transactions.

The average that results is SORA, which will be posted on MAS’ website the next morning at 9 a.m.

MAS has been administering SORA since 2005, so this benchmark is not new. This is why borrowers can be confident about this well-established benchmark.

2. Interest Payments Will be More Stable

In addition to being a higher quality benchmark for interest rates, the interest payments on SORA-based property loans are more stable when compared to SOR- or SIBOR-based loans.

SOR- and SIBOR-based loans typically use one day’s reading for an entire interest payment period, which exposes it to the risk of a single day’s abrupt fluctuations. That one day’s “pin risk” would affect the interest rate for the entire loan repayment period that follows.

On the other hand, banks using SORA usually implement the 3-month compounded SORA rate to determine the interest rate when lending on property. Although SORA is being calculated daily, banks typically use the SORA average over the previous 90 days, making it more stable when pricing their property loans.

Due to this practice, property loans based on SORA will only reflect the rate changes that occur over subsequent months. This gives borrowers more time to prepare for any upcoming changes.

If interest rates are going to change, the interest on your mortgage payments will not be immediate because those changes will happen gradually.

Having said that, SORA-based loans, just like every other floating-rate loan, will fluctuate based on market conditions. This means you will eventually see an adjustment to your interest payments.

Source: The Straits Times

How Homeowners will Benefit from Transitioning to SORA

To summarize, by transitioning to SORA-based property loans homeowners will benefit in two significant ways:

- Since MAS has been administering SORA for more than a decade, it’s become a well-established, transparent, and reliable benchmark on which to base interest rates.

- Since financial institutions are using the 3-month compounded SORA rate that reflects the previous 90-day SORA average instead of just one day’s reading when pricing their property loans, borrowers get interest payments that are less volatile.

Therefore, if you are planning on financing your new home and are considering a floating-rate loan, you would be wise to look into SORA-based loan packages in order to reap the benefits.

Now that the switch to SORA is inevitable, property owners who currently have SOR- and SIBOR-based loans should change ahead of time to another loan package that their bank may be offering. These could include loans based on other reference points like board rates or fixed deposit rates as well as fixed-rate loans.

To assist current borrowers to get out of their SOR-pegged loans, banks will likely offer them a SORA Conversion Package designed to lessen the difference in interest payments when they make the conversion. Contact your bank for all the information.

However, there is no need to get this handled immediately because SIBOR is not set to be discontinued for a while. You can be sure that your bank will be in touch when it’s time to make a move.

ABS, MAS, Steering Committee for SOR & SIBOR Transition to SORA, along with banks and other financial institutions are collaborating together to ensure that all concerned experience a smooth transition to SORA.

Disclaimer: The information provided in this article does not constitute legal advice. We recommend that you get the specific legal advice you need from an experienced attorney prior to taking any legal action. While we try our best to make sure that the information provided on our website is accurate, you take a risk by relying on it.

At Pinnacle Estate Agency, we strongly believe in sharing our real estate knowledge to the public. For more content like this article, check out our Singapore Property Guides.