Homeowners Now Being Motivated to Refinance Thanks to Lower Interest Rates Due to COVID-19

This article discusses the golden opportunity to consider repricing or refinancing home loan in the current low interest environment, difference between repricing and refinancing, and fixed and floating package

The COVID-19 pandemic has created a global financial crisis, but savvy homeowners have found a silver lining that is greatly benefiting them.

All over the world, central banks including the U.S. Federal Reserve (Fed) have cut interest rates in an attempt to stimulate the economy during these uncertain times.

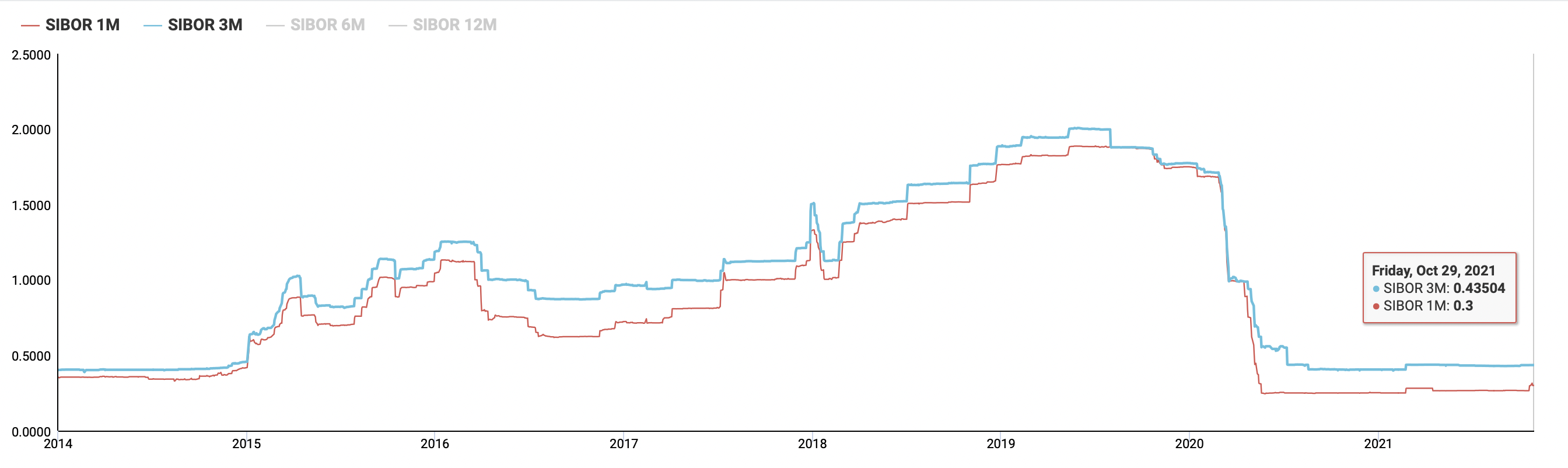

The Singapore Interbank Offered Rate (SIBOR) has also been declining, which is not surprising because it usually follows the Fed’s lead.

This has resulted in banks here reducing interest rates on some home loans, which is great news for homeowners who are struggling to pay their mortgage.

Source: Association of Banks in Singapore Co. (ABS Co.)

Source: Association of Banks in Singapore Co. (ABS Co.)

With floating interest rates on home loans at the lowest they’ve been in recent years, there is no doubt that this is the perfect time for homeowners to look into repricing with their current banks or refinancing their mortgage with another bank.

If your income or overall finances have been negatively impacted by the recession the pandemic created you may want to re-evaluate your existing loans to improve your cash flow. If you are currently paying more than 2% p.a. on your mortgage, this may be more than necessary in the current economic climate. So, it might be a good time for you to refinance.

If you want help to determine which home loan package would be your best option in terms of affordability, our mortgage partners are here to help. Use our Pinnacle Mortgage Calculator to figure out how much money you could save each month by refinancing.

Table of Contents

Which Would Save You More Money – Repricing or Refinancing?

Repricing vs. Refinancing – Which is Better?

Should You Choose a Floating or Fixed Rate Home Loan?

How much would homeowner save from refinancing to lower-interest rate package?

Let’s consider one example:

Mr. and Mrs. Ong took out a $500,000 loan from HDB with the maximum tenure of 25 years to buy their 4-room HDB resale flat in Bishan. They are currently paying a 2.6% interest rate, making their monthly repayment a total of $2,136.06.

The couple have now been making payments on their mortgage for nearly two years, leaving them with an outstanding loan balance of about $470,840 with a loan tenure remaining of 23 years.

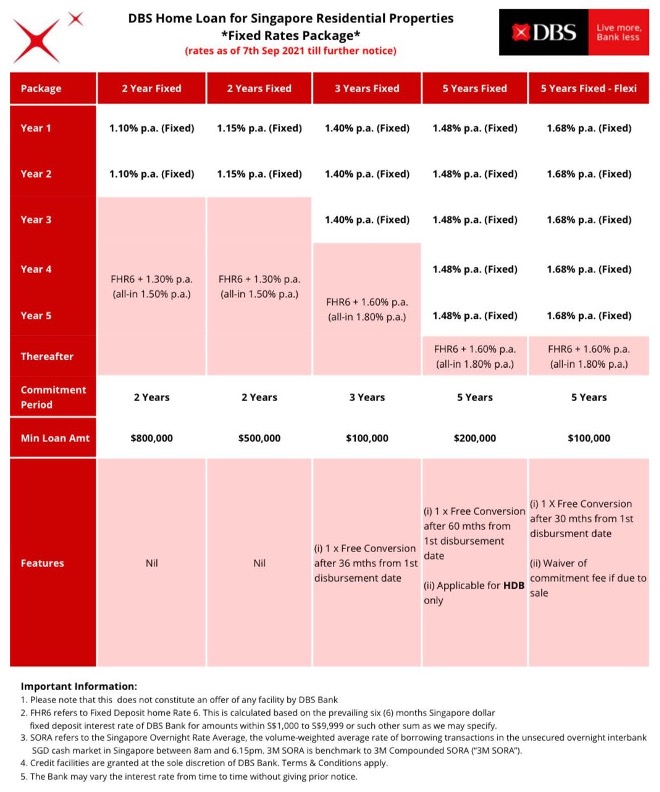

After reading that interest rates are now at record lows, they decided to find out if they could save money by refinancing their home loan. After speaking with a banker at DBS Bank (one of our mortgage partners) they refinanced to a 5-year fixed DBS Home Loan at 1.48% p.a.

DBS Bank also offers borrowers who refinance with them from other banks, financial institutions or HDB a $2,000 cash rebate if their loan amount is more than $250,000. The $2,000 will usually be enough to cover the valuation fee and legal costs incurred when refinancing from an HDB Loan to a Bank Loan.

Let’s look at the Loan Analysis to determine whether Mr. and Mrs. Ong would benefit from refinancing with DBS Bank:

|

Loan Analysis on Mr. and Mrs. Ong’s HDB Flat |

||

|

|

Current Loan |

Refinanced Loan |

|

Balance Owed on Loan |

$470,840 |

$470,840 |

|

Balance of Loan Tenure |

23 Years |

23 Years |

|

Estimated Monthly Instalment |

||

|

$2,136.06 |

$2,013.78 |

|

$2,136.06 |

$2,013.78 |

|

$2,136.06 |

$2,013.78 |

|

$2,136.06 |

$2,013.78 |

|

$2,136.06 |

$2,013.78 |

|

- |

- |

|

|

||

|

Interest Rate |

||

|

2.60% |

1.48% |

|

2.60% |

1.48% |

|

2.60% |

1.48% |

|

2.60% |

1.48% |

|

2.60% |

1.48% |

|

- |

- |

|

|

||

|

Total Estimated Interest Paid |

||

|

$12,062.04 |

$6,851.30 |

|

$11,663.20 |

$6,593.30 |

|

$11,253.86 |

$6,331.48 |

|

$10,833.77 |

$6,065.72 |

|

$10,402.61 |

$5,796.02 |

|

$56,215.48 |

$31,637.82 |

|

Money Saved on Interest |

$24,577.66 |

|

After refinancing their HDB home loan by switching over to DBS Bank, their monthly mortgage payment will be $2,013.78 rather than $2,136.06, which saves the couple $122.28 each month.

They end up paying more toward their principal with every monthly instalment, saving a total of $24,577.66 in interest, not just $122.28 x 60 months = $7,336.80 as more percentage of the payment goes towards the equity than interest. Had they not refinanced, they would have had to pay HDB $24,577.66 in unnecessary interest.

Be advised that once you refinance your HDB loan with a bank loan, you cannot at some point in the future switch back to an HDB loan. The HDB 2.6% Concessionary Rate has been extremely stable for a long time, so this is something to consider as you make your decision.

Repricing vs. Refinancing – Which is Better?

When repricing your loan, you are switching over to a less expensive loan package with the same bank or financial institution your existing loan is with. But when refinancing, you take out a loan with another bank or financial institution, paying off your current loan. The purpose of doing this is to benefit from a lower interest rate other banks may offer, which saves you money.

If you turn to another bank to refinance your home loan, they will evaluate the risks by conducting a background check, reviewing your pay stubs, and doing a valuation on your property. There is always a chance that you won’t qualify for the same type of loan that you currently have if there has been a change in your financial situation – if you are making less money than before, for example.

When you reprice a loan, you’ll face less paperwork and avoid going through the ordeal of a credit check and the costs of legal and valuation fees.

Repricing and refinancing are both for the purpose of reducing the monthly instalment amount by having a lower interest rate on the loan.

We would recommend that you first look into repricing, before considering refinancing. When you start exploring refinancing options, ask those banks or financial institutions whether they offer a cash incentive or subsidy to cover the costs of legal and valuation fees as these can amount to $2,000 to $3,000.

A homeowner who refinances within the lock-in period would be required to pay a fee of 1.5% of the outstanding balance on the loan. This is why most homeowners wait until about three months (to coincide with the notice time banks usually require) before their lock-in period ends to start looking into their options for repricing or refinancing their home loan.

Should You Choose a Floating or Fixed Rate Home Loan?

There are basically two different types of interest rates in the marketplace: floating rates and fixed rates. Although a “fixed rate” implies that the interest rate will stay the same for the life of the loan, in reality the rate will only be fixed for a period of two or three years. In some cases, lenders will offer to keep the rate the same for one or five years.

On the other hand, when you are offered a floating rate loan package, the interest rate will not be fixed for any particular period of time. From the start, the rate will depend on a reference rate based on market indicators. These could include the Singapore Overnight Rate Average (SORA), which is transparent. Or, the rate could fluctuate according to a fixed deposit rate or a bank’s board rate, both of which would likely be less transparent.

When you choose a floating rate loan, you can expect more volatility. When rates fluctuate every month to three months, the monthly amount you pay on your mortgage would change accordingly.

If interest rates are low, as they are now, when you take out a home loan a fixed rate loan would be the best option. The same holds true if you want a predictable budget over the first few years of your loan. On the other hand, we would recommend a floating rate loan if you were fairly certain that interest rates are headed downwards.

For more details, read How to Choose Between Fixed and Floating Rate Home Loan?

If you are wondering whether to refinance your home loan, please click on Contact Pinnacle and our Key Executive Officer, Mr. Sumitro Ong will be happy to assist you and if necessary, refer you to our mortgage partners.

Disclaimer: The information provided in this article does not constitute legal advice. We recommend that you get the specific legal advice you need from an experienced attorney prior to taking any legal action. While we try our best to make sure that the information provided on our website is accurate, you take a risk by relying on it.

At Pinnacle Estate Agency, we strongly believe in sharing our real estate knowledge to the public. For more content like this article, check out our Singapore Property Guides.