Can I Use CPF Monies to Pay for Second or Subsequent Properties in Singapore?

This article shows some examples of how you can use your CPF monies to pay for second or subsequent properties

If you already own property or a number of properties in Singapore, you still may want to buy even more property. You might be trying to weigh various investments, buy a home you’d like to live in when you retire, or perhaps homes for your parents and/or children.

It seems everyone asks the same question when it comes to this, “Will I be allowed to withdraw CPF funds to pay for a second or additional properties?”

YES, you can use your CPF savings!

So, you can now relax knowing that you are allowed to withdraw funds from your CPF savings in order to buy second or subsequent properties. On the other hand, it won’t be as easy as it was when you bought property the first time around.

Before I elaborate, let’s consider the Basic Retirement Sum (BRS) along with the Full Retirement Sum (FRS), so that you better understand the examples detailed below:

The Basic Retirement Sum affects those who had their 55th birthday in 2016 to 2022:

|

55th Birthday on or after |

Basic Retirement Sum |

|

2016 |

$80,500 |

|

2017 |

$83,000 |

|

2018 |

$85,500 |

|

2019 |

$88,000 |

|

2020 |

$90,500 |

|

2021 |

$93,000 |

|

2022 |

$96,000 |

The Full Retirement Sum affects those who had their 55th birthday in 2003 to 2022:

|

55th Birthday on or after |

Basic Retirement Sum |

|

1 July 2003 |

$80,000 |

|

1 July 2004 |

$84,500 |

|

1 July 2005 |

$90,000 |

|

1 July 2006 |

$94,600 |

|

1 July 2007 |

$99,600 |

|

1 July 2008 |

$106,000 |

|

1 July 2009 |

$117,000 |

|

1 July 2010 |

$123,000 |

|

1 July 2011 |

$131,000 |

|

1 July 2012 |

$139,000 |

|

1 July 2013 |

$148,000 |

|

1 July 2014 |

$155,000 |

|

1 July 2015 & 2016 |

$161,000 |

|

1 July 2017 |

$166,000 |

|

1 July 2018 |

$171,000 |

|

1 July 2019 |

$176,000 |

|

1 July 2020 |

$181,000 |

|

1 July 2021 |

$186,000 |

| 1 July 2022 |

$192,000 |

Here we are going to discuss on second or subsequent property purchased after the new CPF rules kicked in on 10 May 2019.

The amount you can withdraw from your CPF savings for the purchase of a second or additional properties depends on how long the remaining lease is on at least one of the properties you already own or are buying, whether you’ve used your CPF funds to pay for the property, and if it can cover the youngest buyer until they are 95.

Here are some of the most common circumstances:

- The years remaining on the lease of at least one of your properties or one that you are buying, in which you’ve used CPF funds to buy the property, can cover you until you reach 95 years of age, and you are currently under 55 or over 55.

- The number of years remaining on the lease of all your properties or the ones you’re buying, in which you’ve withdrawn CPF funds to make the purchase, will not cover you until you reach 95 years of age when you are currently under 55 or over 55.

Example #1:

If you are under 55 years of age, and you have withdrawn funds from your CPF savings to buy your first property and sometime after, you buy a second property or even multiple properties in which one can cover you until you reach 95 years of age.

In this situation, you must put aside an amount of money equal to the current BRS before you are allowed to use any more of your savings in your CPF Ordinary Account (up to the purchase price or the valuation limit, whichever is lower) to make another property purchase.

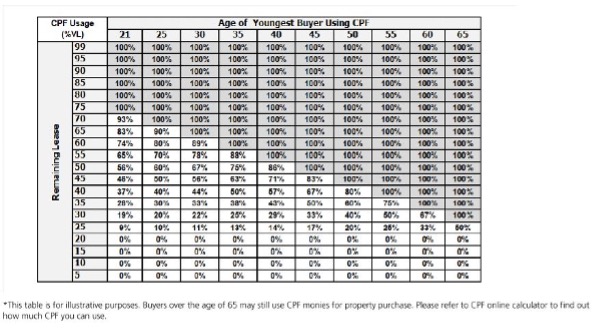

The maximum amount of CPF savings you can use depends on how long the remaining lease is on the property and how old the youngest buyer is who is using their CPF savings to buy the property. The remaining lease must be long enough to cover them until they reach 95 years of age.

Example #2:

If you are 55 years of age or older, you are required to set aside an amount of money in your CPF Retirement Account (RA) equal to your BRS before you are allowed to withdraw the balance in your CPF Ordinary Account savings to make a second purchase.

As long as at least one of the properties will cover the youngest buyer until they reach 95 years old, you can withdraw funds from your RA savings (except earned interest, Government grants, and top-ups you made using the Retirement Sum Topping-up Scheme) above and beyond your BRS, when you are eligible or the CPF board gives their approval.

Example #3:

If you own no properties and are not purchasing any properties in which you have withdrawn monies from your CPF savings to pay for the first property you purchased and you have a lease with not enough years remaining to cover you until you turn 95.

If you are under 55 years of age, you must set aside an amount of money equal to the current Full Retirement Sum before you are allowed to use any more funds in your CPF Ordinary Account to buy a second or additional properties. The maximum amount of CPF savings that you’re allowed to use to buy the property will be pro-rated.

Example #4:

If you are 55 years of age or older and neither the property you already own nor are buying can cover you until you reach 95. You must set aside an amount of money in your Retirement Account equal to the Full Retirement Sum before you are allowed to withdraw any excess savings from your Ordinary Account to buy the property.

The CPF OA savings that you are allowed to use to buy the second or additional property is pro-rated because the years remaining on the lease will not cover the youngest buyer until they reach 95 years of age.

If you plan on selling your existing property, so that the property you’re buying would be the only property you used CPF savings to buy, you will have a 6-month grace period to sell the property. During this time, you are not required to put aside the standard BRS or FRS. Your grace period will be:

- Six months from when the Temporary Occupation Permit (TOP) was issued if your new property is still being built; or

- Six months from when the purchase was completed if your new property is completed and not under construction.

Further information on the maximum CPF you’re allowed to use based on the Valuation Limit (%):

Maximum amount of CPF you can use based on the Valuation Limit (%)

Otherwise, if the years remaining on the lease will not cover the youngest buyer until they reach 95 years of age, you may want to use the formula below to calculate the maximum pro-rated amount of CPF savings you can use:

Pro-Rated CPF Usage = (Remaining lease of property – 20) / (95 - age of youngest buyer using CPF – 20)

Note: You are welcome to use our CPF Housing Usage Calculator if you want to determine how much money you can use to buy your second or additional property.

Click to Access CPF Housing Usage Calculator

Summary

YES, you are allowed to use your CPF savings if you want to buy second or subsequent properties. You can withdraw your excess CPF funds to buy your second property once you’ve put aside the required amount of savings for your retirement.

Purchasing your second or additional properties is not as easy as it was when you made your first property purchase because there are a variety of considerations that affect affordability. These include whether the property is affordable, the Additional Buyer Stamp Duty (ABSD) that must be paid, Total Debt Servicing Ratio (TDSR), and the Loan-to-Value (LTV) limit. Read more on Buying Your Second Residential Property: Everything You Need to Know

I hope the information above, and the examples helps you better understand the rules regarding using your CPF savings to buy additional properties in Singapore.

You are welcome to reach out to us if you need professional advice or want more information on CPF savings usage before proceeding with the purchase of second or subsequent properties.

Disclaimer: The information provided in this article does not constitute legal advice. We recommend that you get the specific legal advice you need from an experienced attorney prior to taking any legal action. While we try our best to make sure that the information provided on our website is accurate, you take a risk by relying on it.

At Pinnacle Estate Agency, we strongly believe in sharing our real estate knowledge to the public. For more content like this article, check out our Singapore Property Guides.