8 Estate Planning Tools in Singapore for Peace of Mind

This article discusses the 8 estate planning tools that include Wills and testamentary trusts, CPF nomination, manner of holding property, life insurance policy, Lasting Power of Attorney, Advance Medical Directive, Inter vivos trusts, and distribution of estates owned by Muslims in Singapore

Estate planning is the legal process that individuals undertake, so that their assets are responsibly managed and distributed according to their wishes after their death.

In Singapore, the inheritance tax or estate duties was abolished on 15 February 2008. So, now there is no need to be concerned about limiting or avoiding estate duties being owed by your estate when planning your estate.

This article explains in detail how each of these legal tools works.

Table of Contents

1. Wills and Testamentary Trusts

2. Central Provident Fund Nomination

3. Manner of Holding of Immovable Property

8. Distribution of Estates Owned by Muslims in Singapore

1. Wills and Testamentary Trusts

Wills provide detailed instructions on how the individual wanted his/her estate to be divided up upon his/her death. In preparing your will you should do the following:

- List your assets;

- Name your beneficiaries, but also name alternate beneficiaries in case one or more of your beneficiaries dies when you do;

- Name the executors of your will and/or trustees;

- Decide whether it makes sense to create a trust.

More information is provided on some of these issues below.

Listing Your Assets

There is no need to specifically list every single item you own when a general clause will allow the distribution of all property, whether it’s movable or immovable wherever it’s located. You should give special attention regarding the distribution of immovable property located in other countries. The government of those countries may not consider a probate obtained in Singapore to be valid.

Naming the Executors of Your Will and/or Trustees

Your executors are the people you select whose job it is to present your will to the court in order to obtain probate. Your trustees are the people you select to distribute your assets based on the instructions you set forth in your will. Very often executors and trustees are the same individuals out of convenience. Also, nothing prevents them from being beneficiaries of your will as well.

Executors and trustees are required to be at least 21 years of age when the will goes into effect. You can also name your infants and toddlers as your executors and trustees when writing your will.

You may also want to create a testamentary trust to hold specific properties on trust for your beneficiaries upon your death.

Other Issues

As people sit down to write their will, many are unsure of how they want their estate distributed, to whom they want to leave their assets and in what proportions. You need to know that you are allowed to change your will whenever you want, as long as you are of sound mind when doing so.

If you have not written a will by the time you die the rules in the Intestate Succession Act will determine the distribution of your assets.

2. Central Provident Fund Nomination

The funds in your Central Provident Fund (CPF) will not be part of your estate and therefore cannot be left to your heirs in your will, or through any trust you create. The reason for this is that monies put into CPF accounts are kept on trust for whomever was nominated to receive those monies.

This means that the person(s) that you nominated to receive your CPF monies will receive all the funds in your CPF account.

There may be certain circumstances that prompt you to decide on a different nominee. If the nominee that you chose dies before you it will be necessary to name a new one. Or, if your existing choice is automatically revoked by law now that you’re (re)married.

To change your nomination online, visit CPF Nomination. You must have two witnesses over the age of 21 who will login with their SingPass. Alternatively, you can make appointment with CPF to sign the form in front of the officer who will be the witness.

3. Manner of Holding of Immovable Property

Immovable property usually means real estate, like your house. There are two manners of holding an interest in immovable property, which are “tenancies-in-common” and “joint tenancies.”

Tenancy-in-Common

With a tenancy-in-common each owner enjoys a “severed” ownership share in the property. For example, John owns 45%, Andrew owns 45% and Jeff owns 10% of the house. So, John, Andrew and Jeff can decide to sell their share or handle it any way they wish. A separate interest or share in an immovable property that is held as tenants-in-common can legally be distributed in a will.

Joint Tenancy

With co-owners of immovable property that is held in joint tenancy, each person has 100% ownership of the entire property. According to the law, people registered as co-tenants are assumed to be joint tenants unless they specify that they hold the property as tenants-in-common.

When one joint tenant dies, the remaining owner(s) will inherit the deceased’s share, so they will now have ownership of the entire property. The legal term for this is the “right of survivorship.” The effect on the deceased’s estate is that his/her share in the immovable property is to be divested.

Therefore, according to the right of survivorship, a deceased’s share in immovable property that is held in joint tenancy does not become part of his/her estate and therefore cannot be distributed in his/her will.

When planning your estate, you must decide whether you want your immovable property held in joint tenancy or as tenants-in-common. A married couple may decide it’s best that their matrimonial home be held in joint tenancy, so that when one spouse dies the remaining spouse will assume ownership of the entire property.

If you change your mind, you can always convert the manner of holding of the property from that of a joint tenancy to one of a tenancy-in-common, and the other way around as well.

For more information, please read our article on If an HDB Flat Has Multiple Owners – What Happens When One Dies?.

4. Life Insurance Policies

You can take out life insurance or irrevocable trust insurance (depending on how your estate plan is set up) to benefit your nominee(s). These are insurance policies on your life to financially protect your spouse and/or children, who are likely your nominee(s), after your death. These policies are irrevocable because the nomination is not allowed to be revoked, even by you. The only way the nomination can be revoked is if all nominees agree.

Since life insurance policies are a type of trust, the proceeds distributed from these policies do not form part of the deceased’s estate.

On the other hand, some policies permit subscribers to not fill in the nomination field on the policy. When the nomination field is left blank, the policy’s benefits will be disbursed according to the deceased person’s will.

5. Lasting Power of Attorney

A lasting power of attorney (LPA) is a legal instrument permitting someone, (the donor) to name an individual (the donee) who they authorize to make decisions regarding the donor’s personal welfare and/or real estate interests and other affairs should the donor lose mental capacity. A donor can name up to two donees to act together and/or severally with another replacement donee.

With cases of dementia increasing, by waiving the usual $50 fee paid to the Office of Public Guardian to execute LPA Forms, the government has been trying to encourage Singaporeans to create and file an LPA. This waiver is in effect until 31 March 2023. If you read this article later than 31 March 2023, you need to check to see if it has been extended. Your LPA Form is required to be certified by an attorney or a medical professional.

6. Advance Medical Directives

An Advance Medical Directive (AMD) is a legally binding document signed by you informing your physician that you do not want them using any extraordinary life-sustaining procedures to extend your life should you become terminally ill and are unconscious and/or unable to exercise rational judgment.

You must be of sound mind and at least 21 years of age to be allowed to create an AMD. To be valid, your AMD must be signed by two witnesses who have no vested interest in your death. Plus, one of your witnesses must be your physician.

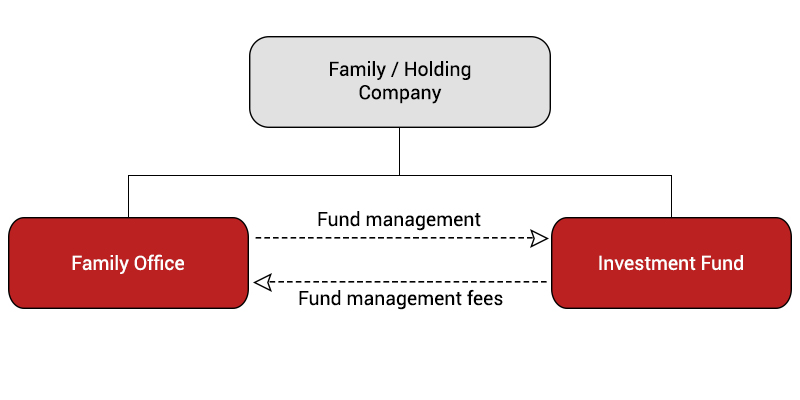

7. Inter Vivos Trusts

The term inter vivos means “between the living” in Latin. An inter vivos trust is a legal instrument created by someone (the settlor) during his/her lifetime for the benefit of someone else (the beneficiary).

Therefore, the settlor places his/her property under the control of the inter vivos trust. The settlor then appoints someone to act as the trustee who manages the property in the trust on behalf of the beneficiary. It’s important to know that the trustee does NOT have to be a trust company.

In creating an inter vivos trust, you as the settlor may spell out when and how you want your property distributed to the beneficiary. You may even spell out the exact conditions that your beneficiary must meet prior to being allowed to receive the property held on trust.

A trust works well in ensuring that your property is passed onto your beneficiary and used according to your wishes, which could be for educational, religious, or medical purposes. A trust is often created to bequeath assets in a will to children under 21 years of age until they are old enough to claim their inheritance.

Your trust can be in the form of a basic deed, which is required to be signed, sealed, and delivered to Singapore’s Inland Revenue Authority, who will stamp it for a fee of $10.

8. Distribution of Estates Owned by Muslims in Singapore

If you are a Muslim living in Singapore, the distribution of your estate will be according to the Application of Muslim Law Act. For more information, read Laws of Inheritance for Muslims Living in Singapore

Conclusion

Estate planning can be overwhelming at time, usually because people do not understand the various options and what information is needed for an effective estate plan. If you need legal advice on one or more of the tools described above, please contact us for a referral to one of our experienced wills and probate partner lawyers.

Disclaimer: The information provided in this article does not constitute legal advice. We recommend that you get the specific legal advice you need from an experienced attorney prior to taking any legal action. While we try our best to make sure that the information provided on our website is accurate, you take a risk by relying on it.

At Pinnacle Estate Agency, we strongly believe in sharing our real estate knowledge to the public. For more content like this article, check out our Singapore Property Guides.